Written by Elvis Shera, Contributor

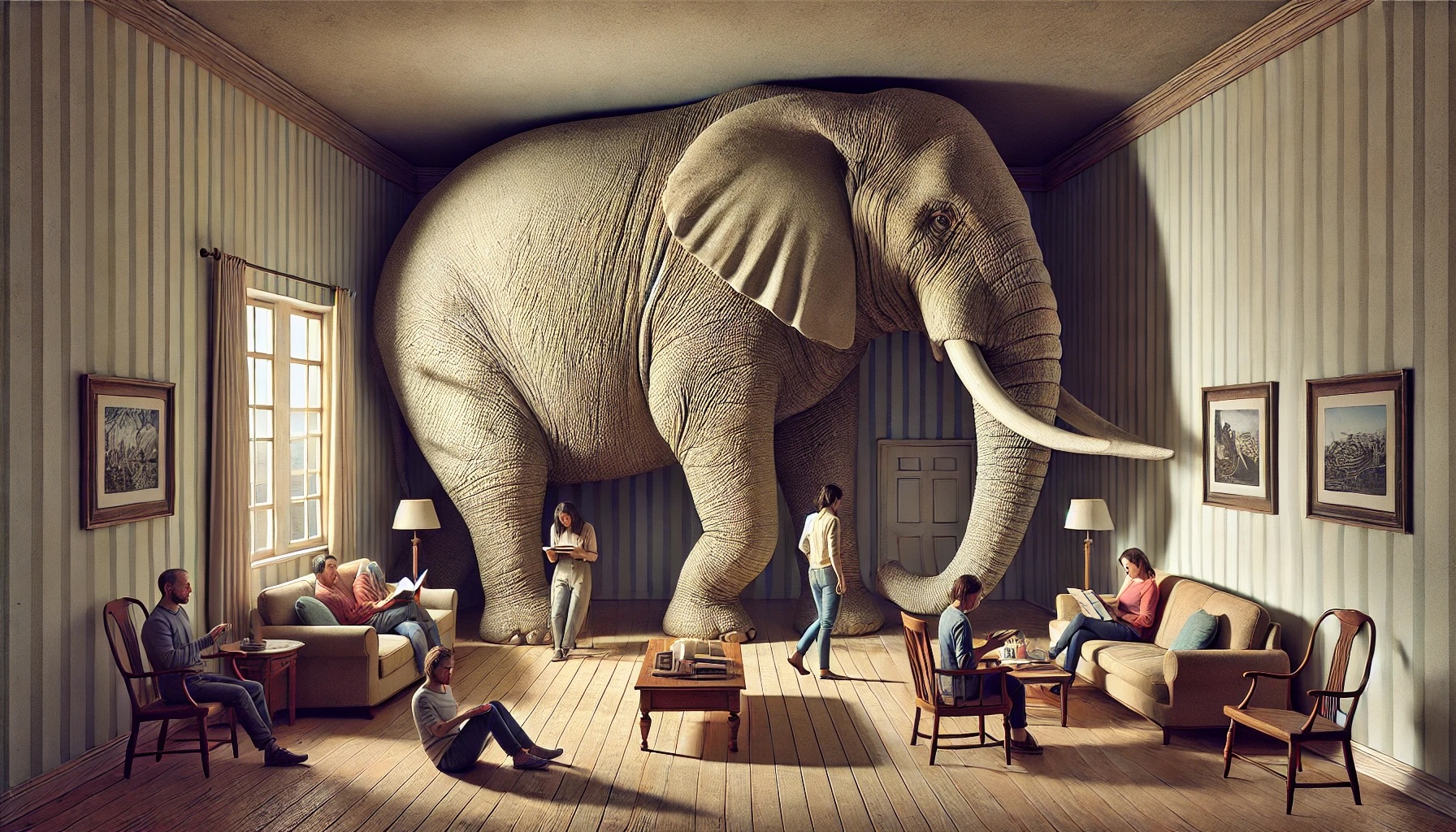

In the article “How Technology is Changing the Way We Transfer Value,” we discussed how technological progress is altering our perception of money and its transfer. In this article, we will focus on a significant problem. A problem that everyone sees but no one talks about or pretends not to notice. It’s like having an elephant in the room. It’s so big that you can’t help but see it. This problem is inflation.

If you want to deepen your knowledge, also subscribe to the channel: “Financially Independent.”

A Very Old Elephant

Inflation did not originate in the modern era. It is an ancient phenomenon. In fact, we have evidence of inflation dating back to ancient Greece, the Roman Empire, and throughout the ages up to the present day. One of the simplest methods was mixing gold coins (money) with other metals like silver and copper to create a larger number of coins. Thus, the amount of currency in circulation increased, but not the quantity of goods and services. In the case of copper, the coin becomes reddish, and in the case of silver, it becomes more yellow.

Clearly, two coins of the same weight, one made of copper and gold and the other entirely of gold, have different values. The gold one will be worth more and will be more sought after as a currency. Additionally, to buy the same thing that a pure gold coin buys, you need more of the coins made of gold and copper. So, when measured with bimetallic coins, the price of goods seems higher. The increase in the number of coins is currency inflation, while the rise in the prices of goods and services is an effect of inflation because we are using a currency that has less value.

It hasn’t always been this way. Kingdoms and empires develop in a regime where the currency used has value. In this way, trade and cultural influence grow along with the empire’s thirst for expansion. Expansion and public spending are initially supported by valuable currency, but soon the empire expands too much, and the amount of money spent to maintain control through armies and mercenary groups is insufficient. These reasons, along with unnecessary spending by the elite, lead to the melting of good currency and its mixing with other metals to create more coins. With a devalued currency, the mercenary groups leave, along with military capacity, and together with the pressures from the subjugated countries, lead to the collapse of empires.

There are other forms of inflation. To create new coins, old coins were cut, creating different edges on a round coin. The metal thus obtained was used for other coins, but the original coin is now worth less because it weighs less.

The Modern Message Promoted by Power, Banks, and the Media

The modern problem with inflation is education. Starting from schools, within families, and in society, inflation is explained by the formula inflation = price increase. This is not true. We saw this with the example of the coins above. Also, the formula fails when we identify other reasons why prices rise. This is very easy to prove. The market operates daily based on supply and demand. If demand increases, prices rise. So, the correct definition is:

“Inflation is the increase in the amount of currency in circulation, while the increase in the prices of goods and services is a consequence of inflation.”

There is a reason why inflation is taught incorrectly. There is a group that has an interest in an education deviated from reality. These are the banks, governments, and their media. Governments and banks are the ones who increase the amount of currency in circulation. So, with the correct definition, responsibility for the effects of inflation falls on the government and banks. Meanwhile, with the incorrect definition, that is, inflation = price increase, responsibility can be shifted to the market, companies, macroeconomic parameters, geopolitical tensions. Of course, there are reasons to create inflation, and we will elaborate on these reasons in due course.

Effects of Inflation on Society

Before we get to the reasons that drive governments, banks, and elite groups to create inflation, we will describe the effects it produces in society. There are three main effects on society:

- Loss of Short-term and Long-term Purchasing PowerWith the loss of purchasing power, individuals and families can buy fewer goods and services with the same amount of money. This is because the increase in the amount of currency is not followed by an increase in the quantity of goods and services. So, there is more money for the same goods and services. Consequently, the price increases.In the short term, there are issues with daily living. Savings at the end of the month are smaller. Dining out becomes less frequent, vacations are reduced, courses are eliminated, and even the choice of cheaper products, compromising quality, becomes necessary.In the long term, there are issues with savings and plans to buy, for example, a house. Inflation has more effect on individuals and families with fixed incomes. These are salaried workers, who feel the impact of inflation more because wage increases are not sufficient to compensate for it. As a result, savings are reduced, decreasing the amount accumulated. At the same time, asset prices, like houses, increase, making it practically impossible to have enough savings to buy them. It’s like trying to catch a Ferrari while riding a donkey.The problem with savings is another one. Central banks try to keep inflation around 2% – 3%. Imagine saving money for your retirement. With an average inflation rate of 2%, 100 Lekë saved will be worth only 41 Lekë after 45 years (meaning you can buy goods worth only 41 Lekë), while at 3% (the Bank of Albania targets around 3%), you will only buy for 24 Lekë.So where did the lost purchasing power go? In fact, it didn’t disappear; it was simply transferred from those who saved to those who created inflation. So, it’s a transfer of wealth or a “legalized theft,” if we want to call it that.The next question is: why 2% and not 4, 5, 10, or 20%? The answer lies in the boiling of the frog…If you put a frog in boiling water, it jumps out, but if you gradually raise the temperature, you will boil it because it adapts gradually. The same happens with inflation. It is a target designed to be slow so that the loss of purchasing power is accepted as modest, but as we saw, the long-term effects are catastrophic.

- Growth of a Consumer SocietyThe effect of declining purchasing power reduces not only the capacity to save because there is less left to save, but it also reduces the desire to save. Meaning, why save when the currency you are saving loses value over time? This approach pushes individuals and families to spend, increasing consumption. It’s better to buy something before its price increases.So, a society under inflation is a consumer society that thinks in the short term. Long-term plans are difficult and uncertain.Increased consumption, i.e., purchasing goods and services at a faster pace, has an effect on GDP (Gross Domestic Product), which is used as an indicator of economic growth or contraction. This is something of interest to the political class, which uses GDP growth as a reference for the economy’s performance. From this perspective, politicians have an interest in inflation.Perhaps the fact that individuals and families cannot make long-term plans is one of inflation’s greatest crimes.

- The Cantillon EffectThe Cantillon Effect, first mentioned by Richard Cantillon, describes how individuals and groups closest to the source of newly created money benefit at the expense of those further away.Although inflation can be seen as new money dropped from a helicopter that could hit everyone equally, Cantillon observes that, in fact, citizens benefit from the creation of currency depending on their proximity to the source. This is certainly unfair because the benefits do not come from business and meritocracy. But how does it work in practice?When new currency is created, the first to receive it are the second-level banks, which use it in two ways: buying assets through financial operations or lending it to their preferred clients.When the new currency is in the hands of this privileged class, because they are close to the source of money, prices in the market have not yet changed because the market has not yet seen the new currency.When this privileged class begins to buy assets, the market starts to feel that there is more money, but the quantity of assets and services in the market has not changed. As a result of supply and demand, asset prices begin to rise. The new money passes from the privileged class to those who sold the assets to them. These who received the money now spend it in the market on other assets and services. In this way, the new money passes from the privileged class, through market exchanges, to the general population.Now that prices have risen, the privileged class sells the assets bought at the initial price at higher prices, realizing profits. Profits achieved simply by their position. Meanwhile, the poorer classes of society do not even get hold of the new money, and in fact, they are excluded from assets because their prices have risen too much.The Cantillon Effect is a scourge on society because it distributes wealth to the privileged in a non-meritocratic manner and harms the lower classes. Clearly, banks and their elite clients are a strong lobby in favor of this phenomenon. The cure for this phenomenon is a return to a stable currency that cannot be arbitrarily printed. Gold, although not perfect, would be a cure for this phenomenon. Of course, this is against the banks’ interests.Read: SunEasy surpasses 2,000 users in just 40 days!

The Inflation Index

The inflation index aims to show how prices have changed from year to year. It is also an indicator of how far inflation is from the central banks’ ideal inflation. So, if central banks want to keep inflation around 3% and inflation is 6%, we have high inflation, and the Central Bank should take measures to bring it down to the 3% level. As discussed above, even a target of 2% would be, in fact, a legalized theft.

But how is this indicator calculated? The Institute of Statistics (INSTAT) creates a basket of necessary products for families and individuals and monitors the price increase year by year to serve the Central Bank, inflation-based agreements, etc. This basket contains over 300 products, and the inflation index is a weighted average of price increases in various items.

The problem with the method is multifaceted. First, baskets can be created in many different ways. For example, we could have a basket with the products every family needs to live (which was the original idea). Examples include bread, dairy, meat, fruits and vegetables, fuel, electricity, gas, transportation, education, etc. Or we could have a basket of luxury products, consisting of Rolex watches, expensive wines, jewelry, etc., products not necessary for survival. Of course, we should be concerned about the first basket, not the luxury one. So, minimally, this logic says there should be different baskets, and they should be reported as such, not mixed together.

Secondly, inflation affects individuals and families differently. For example, if I live in an area where everything is nearby, and I don’t need any transportation, the increase in the price of subscriptions, transport, or fuel does not affect me in the same way. Or if I belong to the middle class and the prices of yachts have increased, it doesn’t concern me at all. So, even with this example, we see that a simply average number, however weighted, has no meaning or utility.

Thirdly, even if we had a proper basket, inflation is not a number but a vector (or a list) of numbers. So, we have inflation in the energy sector, inflation in the food sector, another inflation in the price of houses and rents, and so on. The list would certainly be a more qualitative indicator.

The final problem with the inflation index is that it has become just a number serving current policies. No politician likes to be held accountable for the wild increase in prices, so methods are created to manipulate the index to produce a “better” number.

Examples of manipulation include revising the basket’s components. With such a large number of products, I can remove those products that have seen a price increase and use products that have had a lower increase. In fact, there is no reason why the basket should be frequently revised, even every year, because the primary needs of individuals and families have not changed for thousands of years. We need a house, food, heating, water, etc.

Another method of manipulation is using relative weights for each product. By giving relative weight in creating the index, I have another instrument at hand that allows me to produce the number I want.

The final method of manipulation is resetting the reference figures. For example, by resetting the reference every 4 years to zero (from 100), every 4 years, I start over. So, if I had a decade with a very high average inflation and the last 4 years with low inflation, I just erased the contribution of the previous years and considered a politically more favorable figure.

So, in conclusion, we can say that the inflation index has become a politicized, inefficient indicator, certainly far from reality, because anyone can look at their bills and see that the connection with reality is broken.

Who Creates Inflation?

Inflation is created by central banks and second-level banks. In fact, the central bank creates it at the government’s request, using treasury bonds as collateral or by increasing the reserves of second-level banks. In this context, the Bank of Albania is like the bank of banks. If you want to learn more about inflation, I invite you to watch this video on the channel “Financially Independent” What is Inflation?

This increased amount, which we can call M1, is not the biggest problem. The money in the market increases more through credit by second-level banks. Imagine how many times a loan is taken out at a bank, for example, because you buy a house, the bank creates that value from nothing. For more, watch the video on How the Banking System Works. So, the amount of all this currency in circulation and having real effects, let’s call it M2, is many times greater than M1. We can even say up to 10 times.

We can say that the power and privilege that banks have is enormous and requires great responsibility to manage. Otherwise, we have continuous crises and monetary collapses, as happens in many countries.

Reasons Driving Inflation

Inflation is not a natural effect in the economy. It is artificial and happens with the creation of central banks or authorities that take ownership of currency issuance. The banking system, along with governments and clientelist elements, have an interest in maintaining a level of inflation. We saw that one of the reasons is the Cantillon effect, where the class closest to the source of new money benefits “at no cost.”

Furthermore, modern governments have grown by employing a large number of individuals, so the state has become the largest employer with significant costs. This cost, along with social programs, has made taxation increase, but taxation cannot be increased toward 100%.

Governments have found more efficient methods to finance a giant apparatus. While they increase and invent new taxes, they take money from the population through inflation. As we saw, inflation is a transfer of purchasing power from individuals and families to those who create inflation. So, inflation is a hidden indirect tax.

What Can We Do to Protect Ourselves?

We all need to protect ourselves from inflation. It is a very high priority for all the reasons we mentioned. It is theft of your energy. It drives you towards consumerism and does not allow you to create a strategy and long-term plans. It is not easy, but the idea of protecting yourself from inflation is to save your work energy outside of currencies. Also, protecting yourself from inflation requires discipline and a long-term plan. The ways we can protect ourselves are numerous, but in principle, we need assets that cannot be increased at the speed of pressing a “button.” Real estate, land, shares in public companies, and investments in private businesses (private equity), gold, cryptocurrencies like Bitcoin can be the best instruments for saving. The criteria for choices depend on your approach to price volatility and what your time window and capital opportunities are.

Of course, this article is not financial advice; it is an analysis and an opinion of the author. If you want to know more about investment opportunities, you can subscribe to the Substack platform column “Financially Independent.”

0 comments