In a world where technology is evolving day by day, T-Blocks is serving as an open window bringing a new breath to the world of investments in non-fungible assets. This Albanian startup is dedicated to utilizing blockchain technology and tokenization to make investments in non-fungible properties easier and more accessible. T-Blocks has a clear vision to unite asset developers and investors from around the world on a transparent and innovative platform. This is a significant step towards a more open and efficient market for all those interested in non-fungible assets. For this reason, Business Magazine conducted an interview with one of the founders of T-Blocks, Henri Ndreca.

- What inspired you to establish T-Blocks, and why did you choose to focus on the market of non-fungible assets in the Balkan countries, such as Albania?

T-Blocks, also known as Tokenized Blocks, is inspired by the potential that blockchain technology has shown for reshaping the economy, financial markets, and digitizing non-fungible assets. During 2022, together with my partner Eni Shtini, we were exploring the applications of this technology in Albania and the Balkans. Starting from the interest of one of our clients in raising capital from global investors for an asset in Italy through blockchain technology, we identified a business opportunity with a vision to democratize real estate investments. T-Blocks was created in December 2022, aiming to become the first platform in Albania and the Balkans that connects asset managers with foreign capital through European and international legal frameworks.

Currently, Albania and the Balkans are at a crucial point of development, with significant investments in infrastructure and a clear path towards the EU, increasing the long-term value of real estate. Last year's tourism record in Albania, along with the presence of international hotel brands such as Marriott, Melia, and Radisson, demonstrate the country's great potential for the coming decade. These developments not only enhance foreign investor interest in accessing the market but also require substantial capital for the construction of hotel and residential projects to international standards. In the context of these developments, the integration of blockchain technology into the investment sector in Albania and the Balkans offers a unique opportunity to generate impact and value in the regional economy.

- How has your personal and professional experience influenced the creation of T-Blocks?

I believe T-Blocks is part of a journey that I personally embarked on at the age of 15-16, where I first encountered blockchain technology and the economy. The passion to fully understand global financial markets and this new technology, which few people mastered, led me to complete my early academic theses on crypto-assets and decentralized finance at university, where I also covered the concept of tokenization that T-Blocks applies today. Later, I translated the world bestseller "The Bitcoin Standard" into Albanian, making it the first book on cryptocurrencies in the Albanian language. At that moment, I understood that my natural tendencies were guiding me towards the world of entrepreneurship, and precisely then, I had the opportunity to work on the first serious Web3 project in Albania, called ViAl. Through this project, I met fantastic and energetic people in our small startup ecosystem, but I also realized how challenging it is to launch an ambitious and innovative project.

Simultaneously, the founding of T-Blocks with Eni had begun, who also shares a passion for entrepreneurship and technology. With our combined professional experience, I believe T-Blocks has many more years behind it than it seems.

- How do you use blockchain technology and the tokenization of assets to create investment opportunities in real estate?

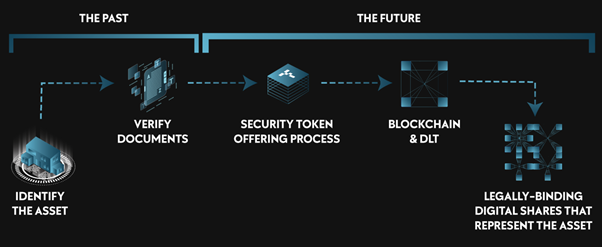

Blockchain technology can be thought of as a large transparent database accessible by anyone worldwide in real-time, 24/7, with just an internet connection.

Our blockchain-based platform reduces third parties and offers a transparent, fast, and cost-effective process for the transfer or trade of tokenized assets. Through blockchain, T-Blocks enables the transformation of real estate into digital shares through the process of tokenization and fractionalization, aiming to lower investment barriers for a large portion of society. Additionally, blockchain technology provides a transparent, fast, and cost-effective process for the online transfer or trade of these digital fractions in just a few minutes.

On the other hand, real estate developers have the opportunity to access alternative capital, avoiding key project financing challenges associated with pre-selling apartments at low prices and clearing. These practices result in missed profits for developers due to premature sales at low prices and jeopardize the project's continuity.

- How does the property tokenization process work, and how do you ensure that this process is reliable and applicable within the regulatory framework of the European Union?

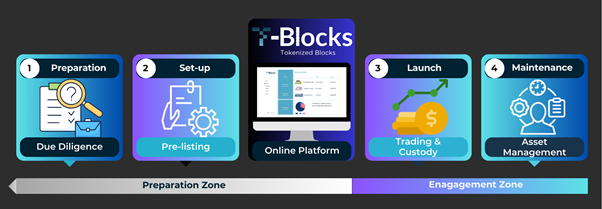

T-Blocks has been built from day one, taking into account global regulatory frameworks. Therefore, throughout this year, we have developed and expanded our European and American partner network to serve the needs and future challenges in the region. The entire legal process of tokenization adheres to European capital raising rules and includes strict procedures that ensure the trust and credibility foreign investors seek in regional investments.

In collaboration with our global partner network, T-Blocks assists its clients seeking to tokenize development projects in search of alternative financing methods by preparing an institutional-level investment dossier. Once we ensure that our clients have met all the required standards, through the tokenization process, we can transform projects into digital shares and then list them on the platform, enabling access to global investors and investment funds.

- How do you define T-Blocks' mission in transforming real estate investments in the Balkans and Europe?

T-Blocks' mission is to transform the way investments are made in Albania and the Balkans. We aim to bring together real estate developers and asset managers with global investors through innovative technologies, adhering to international regulatory frameworks.

- What are your specific goals in improving global investor access to non-fungible properties?

For global investors, including the Albanian diaspora, investing in Albania poses challenges and high risks due to underdeveloped financial markets. However, recognizing the significant potential of the region on its path to the European Union, a considerable number of investors are showing interest in incorporating exposure to this area into their portfolios through the international investment and tokenization structures that T-Blocks provides. Our goal is to reduce investment barriers and alleviate the perceived risks for investors, thus facilitating foreign direct investments. We are aware that foreign investments have a significant impact on GDP growth and the overall well-being of a country. They contribute to economic standardization, financial inclusion, and open the door to new investment opportunities.

- How do you envision T-Blocks contributing to the overall improvement of the non-fungible real estate market in the region?

The primary impact of T-Blocks will be on the investment market and capital raising, but we can anticipate an indirect impact on the real estate market in terms of raising construction standards in an effort to meet international excellence, attracting foreign asset management brands that will serve global investors, creating larger and more ambitious projects, and reducing informality. I see T-Blocks as a missing bridge that will finally integrate global capital markets with the opportunities of developing countries that have ongoing needs for liquidity and expertise to fulfill their potential.

- What are the next steps and development projects for T-Blocks?

Currently, with our advisors and mentors, we have initiated a financing round that will provide us with the opportunity to accelerate the tokenization and capital growth for the secured assets

0 comments