On the first official working day of this year, it is impossible not to chit-chat among colleagues that "the minimal salary has increased".

What has happened?

The Fiscal Package 2022 amended the following laws:

The Law no. 113/2021, On an amendment to the Law no. 8438, dated 28.12.1998, "On income tax", as amended

The Law no. 111/2021, For some additions and amendments to the law no. 92/2014 "On value added tax in the Republic of Albania", as amended

Law No. 114/2021, On some amendments and additions to the law no. 61/2012, "On excises in the Republic of Albania", as amended

Law no. 112/2021, For some additions to law no. 9975, dated 28.7.2008 "On national taxes", as amended

The non-taxable base has shifted from 30,000 ALL, to 40,000 ALL

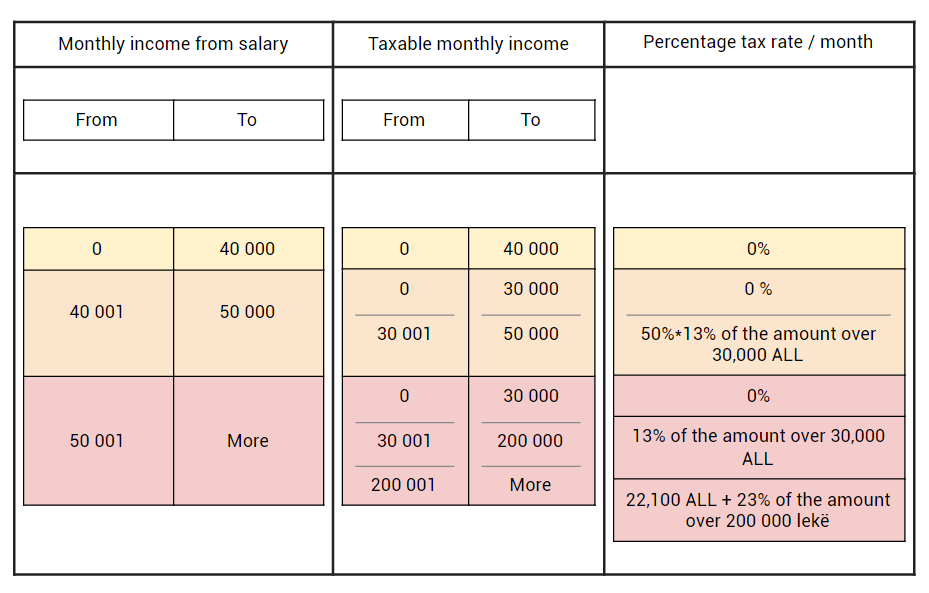

Personal income tax from employment

Taxpayers with incomes up to 40,000 ALL will not pay income tax.

Taxpayers with incomes from 40,001 to 50,000 will pay income tax only on the amount over 30,001 ALL, which will be calculated 50% * 13% of the amount over 30 000 ALL.

Taxpayers with incomes more than 50,001 ALL will not be taxed on income up to 30,000 ALL.

The tax rate of 13% will be calculated only on the band 30,001 ALL - 200,000, while for incomes over 20,001, the tax rate will be calculated 22,100 ALL + 23% of the amount over 200,000 ALL.

In other words, the tax rate of 13% has been nominated for taxpayers with incomes from 40,001 ALL / month to 50,000 ALL / month. While the tax rate of 23% will be applied on salaries over 200,000 ALL / month.

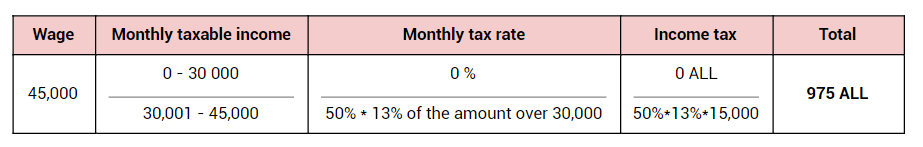

For example

Jani earns 45,000 ALL per month.

Starting from this July, the tax rate will be calculated as in the table below:

The law no. 113/2021, For an amendment to the law no. 8438, dated 28.12.1998, "On income tax", as amended, will extend its effects starting from July 1, 2022.

The new legal changes will be reflected in the amendment and repeal of other acts. One of them will be the Decision of the Council of Ministers no. 1025, dated 16.12.2020 "On determining the minimum wage at the national level", the repeal of which will be done with the approval of another DCM that will determine the value of the basic monthly minimum wage at the national level.

Until then, follow us for other legal updates by subscribing here.

0 comments